A simpler, faster way to get market data

Join 3,000+ leading firms and high-growth startups that use our

APIs.

Real-time and historical market data, direct from colocation sites.

Market data APIs and solutions

View all supported venues ->Equities

15 exchanges and 30 ATSs—all stocks and ETFs from direct L3 prop feeds and SIPs.

Futures

Futures, spreads, and options from CME, CBOT, NYMEX, COMEX, ICE, Eurex, and EEX.

Options

All 18 US equity options exchanges, covering trades, quotes, NBBO, OHLCV, and more.

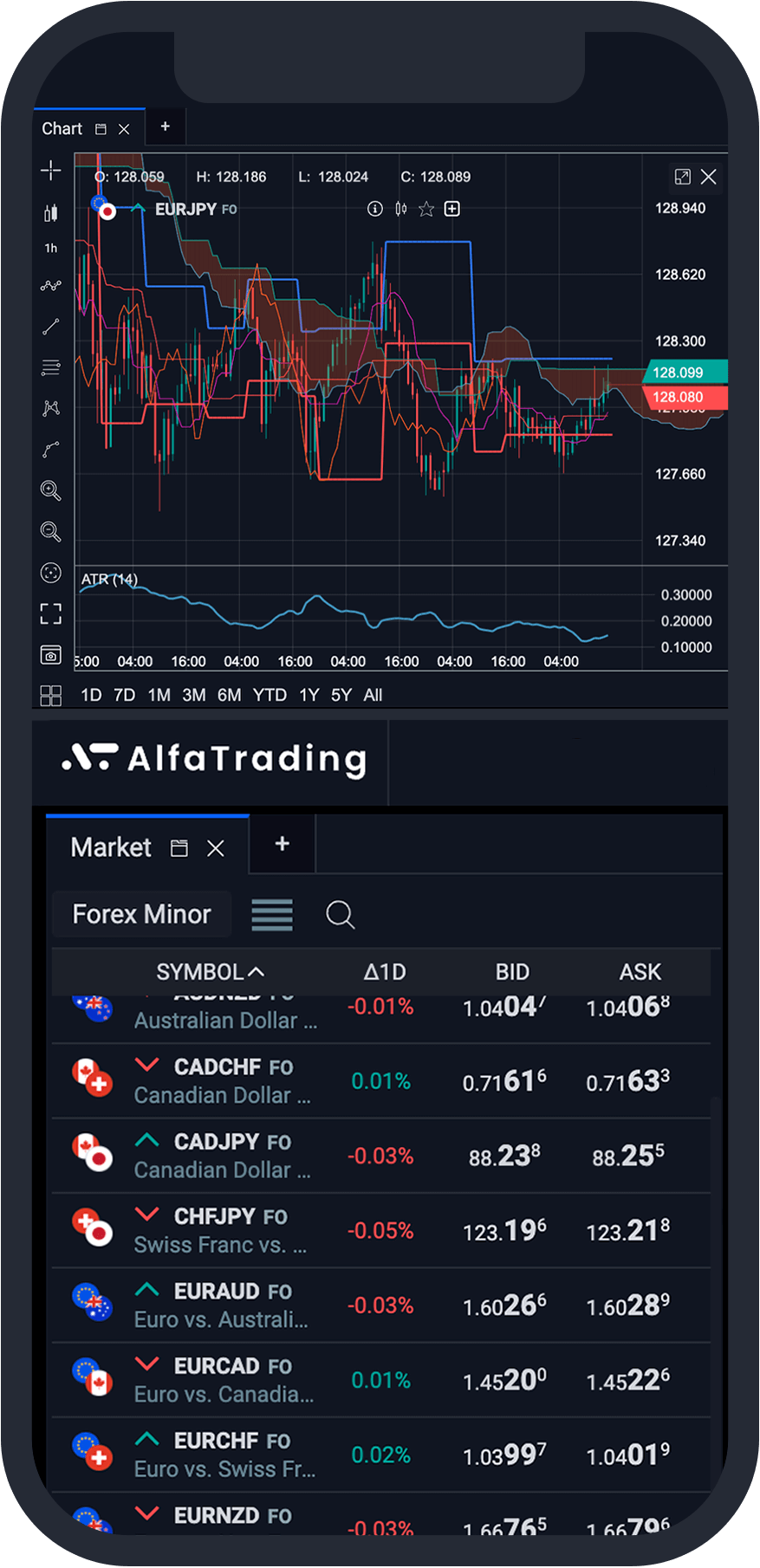

Spot FX

Over 100 currency pairs, including majors & cross-rates, from 40+ liquidity providers.

Live data

Real-time, delayed, and intraday data streaming feeds.

Historical data

Up to 15 years of normalized data. Over 3 million active symbols. 19 PB of coverage.

Reference data

Corporate actions, adjustment factors, and security master for over 200 trading venues.

Packet captures

Raw PCAPs in native protocol delivered with nanosecond-resolution hardware timestamps.

Build your first application in 4 lines of code

ScaleTrade works with any language through our Raw API, which uses a binary protocol over TCP, and our HTTP API. We also provide client libraries for Python, C++ and Rust.

1 2 3 4 5 6 7 8 9 10 11 12

import ScaleTrade as db

client = db.Historical('YOUR_API_KEY')

data = client.timeseries.get_range(

dataset='GLBX.MDP3',

schema='mbo',

start='2023-01-09T00:00',

end='2023-01-09T20:00',

limit=100,

)

data.replay(print)Getting Started

Step-by-step guide to create your first ScaleTrade application.

Examples

Examples to help you get up and running with historical and real-time data.

API Reference Historical

APIs and client libraries for receiving historical data older than 24 hours.

API Reference Live

APIs and client libraries for receiving real-time and intraday history from the last 24 hours.

Market by order

Market by order, full order book, L3.

Market by price

Market by price, market depth, L2.

Market by price

Top of book, trades and quotes, L1.

Trades

Tick-by-tick trades, last sale.

Top of book

Top of book, sampled in trade space.

OHLCV (Bars)

Aggregates per second, minute, hour, or day.

Statistics

Intraday and end-of-day trading statistics.

Definitions

Point-in-time instrument definitions.

Imbalance

Auction imbalance, order imbalance.

Publisher ID

The publisher ID assigned by Databento, which denotes the dataset and venue.

Instrument ID

The numeric instrument ID.

Order ID

The order ID assigned by the venue.

Timestamp (event)

The matching-engine-received timestamp expressed as the number of nanoseconds since the UNIX epoch.

Timestamp (receive)

The capture-server-received timestamp expressed as the number of nanoseconds since the UNIX epoch.

Timestamp (sending)

The matching-engine-sending timestamp expressed as the number of nanoseconds before ts_recv.

Price

The order price where every 1 unit corresponds to 1e-9, i.e. 1/1,000,000,000 or 0.000000001.

Action

The event action. Can be Add, Cancel, Modify, cleaR book, Trade, or Fill.

Size

The order quantity.

Flags

A bit field indicating event end, message characteristics, and data quality.

Expiration

The last eligible trade time expressed as a number of nanoseconds since the UNIX epoch.

Strike price

The exercise price if the instrument is an option. Converted to units of 1e-9, i.e. 1/1,000,000,000 or 0.000000001.

Get range

Stream time series data using our Historical API.

Submit job

Submit a batch job to extract historical data files in bulk.

Download

Download a completed batch job.

Resolve

Resolve a list of symbols into their exchange specific identifier.

List publishers

List all our dataset publishers.

List datasets

List all our available dataset names.

Get cost

Get the cost in US dollars for a historical streaming or batch download request.

Get dataset range

Get the available date range for a dataset.

List schemas

List all available market data schemas for a dataset.

Every book update

Every order execution, add, cancel, replace, book snapshot, and more. By the nanosecond.

Tick-by-tick

Every trade and quote. By the nanosecond.

1 second

Subsampled BBO, last sale, and OHLCV aggregates by the second.

1 minute

Subsampled BBO, last sale, and OHLCV aggregates by the minute.

Hourly

OHLCV aggregates by the hour.

Daily

Daily market statistics, indicative opening and closing prices, OHLCV aggregates, and more.

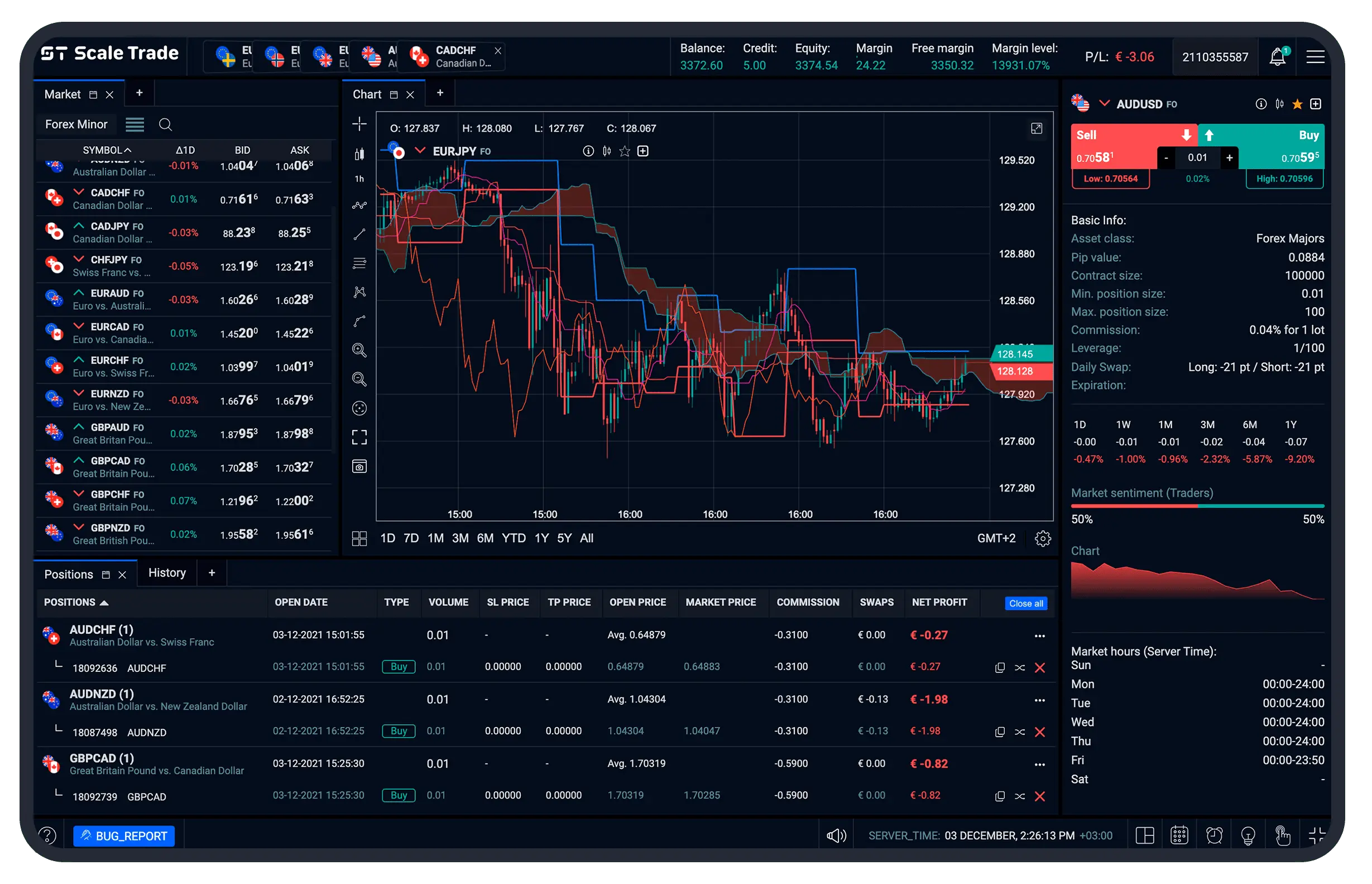

The market data platform you’ll enjoy using

Get instant pricing

Only pay for the data you use with usage-based pricing, or get unlimited data for a flat rate.

Manage licenses in one place

Answer a short questionnaire to determine your monthly license fees and activate live data.

Teams

Administrate billing, entitlements, and multiple users directly on our self-service portal.

Optimized for Pandas dataframes

Get market data in dataframes at over a million rows per second.

Multiple encodings

Choose between CSV, JSON, and our highly-compressible binary encoding, DBN.

Nanosecond, PTP-synchronized timestamps

The only normalized market data solution to provide up to four timestamps for every event, with sub-microsecond accuracy across venues.

Tick-by-tick with full order book depth

All buy and sell orders at every price level. Get each trade, every tick, and order queue composition.

Entire venue in a single subscription

Subscribe to every update of every symbol on the venue, in a single API call—like a direct feed—be it over internet or cross-connect.