Broker CRM

That runs your operation

Automate sales, retention, compliance, and finance in one platform — so your team spends less time on routine and more time growing revenue.

Core Features

Everything your brokerage needs to run sales, compliance, finance, retention, and reporting in one system.

Lead Management & Sales

- Lead capture from all sources

- Automated lead distribution

- Flexible sales pipelines (FTD / STD / Retention)

- Full interaction history per client

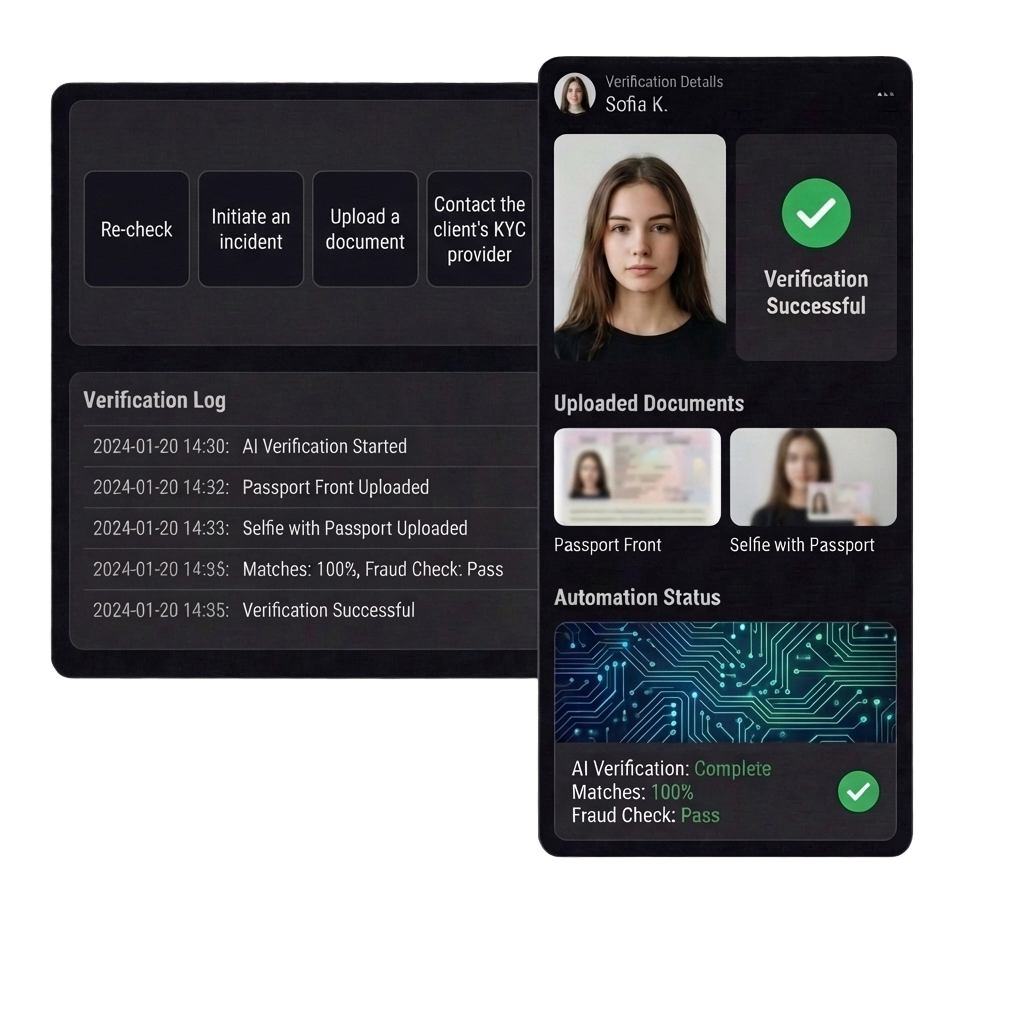

KYC / AML & Compliance

- Built-in KYC workflows

- Document upload and verification

- Verification status tracking

- Full audit logs and activity tracking

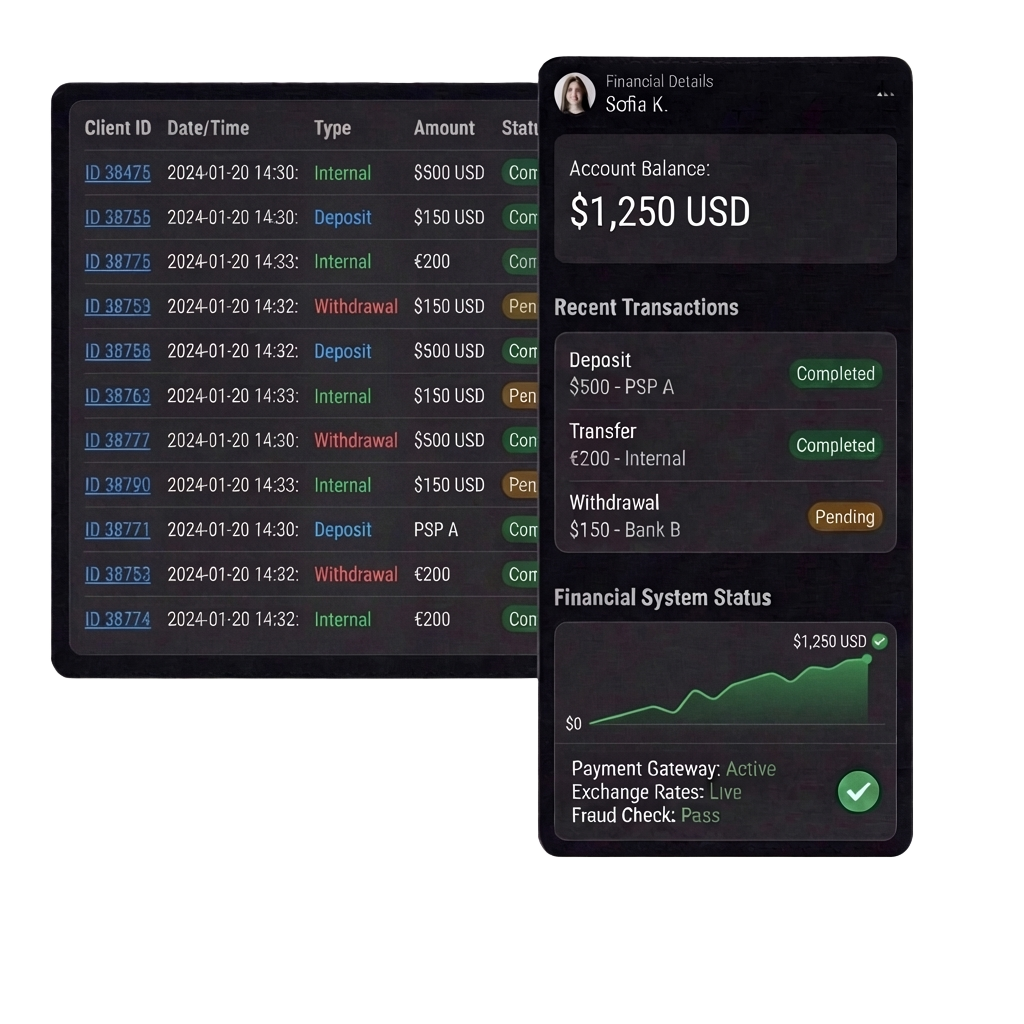

Deposits & Withdrawals

- Deposit management

- Payment status tracking

- Withdrawal approval workflows

- Full transaction history per trader

IB & Affiliate Management

- IB and affiliate structures

- Commission and rebate models

- Referral tracking

- Detailed partner performance reports

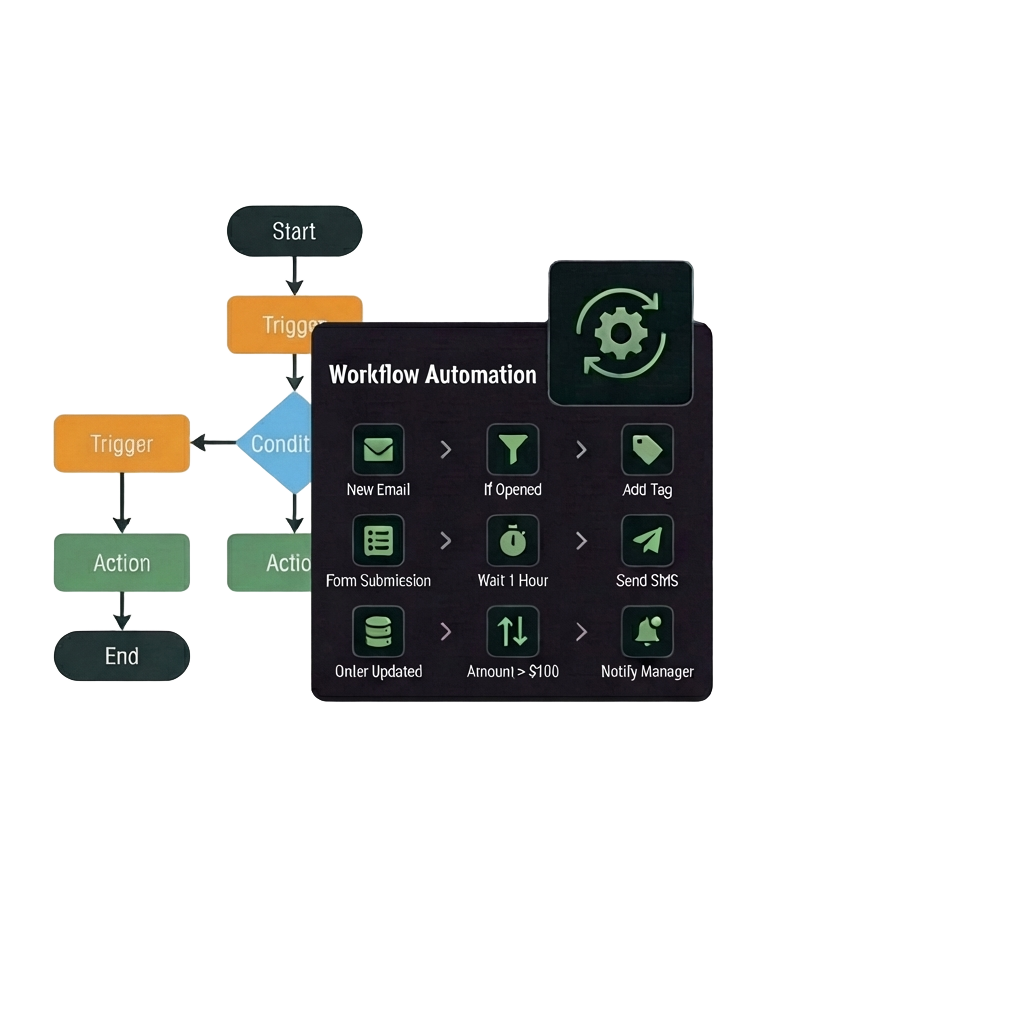

Retention & Automation

- Automated retention tasks

- Behavior-based triggers

- Client communication workflows

- Increased trader lifetime value (LTV)

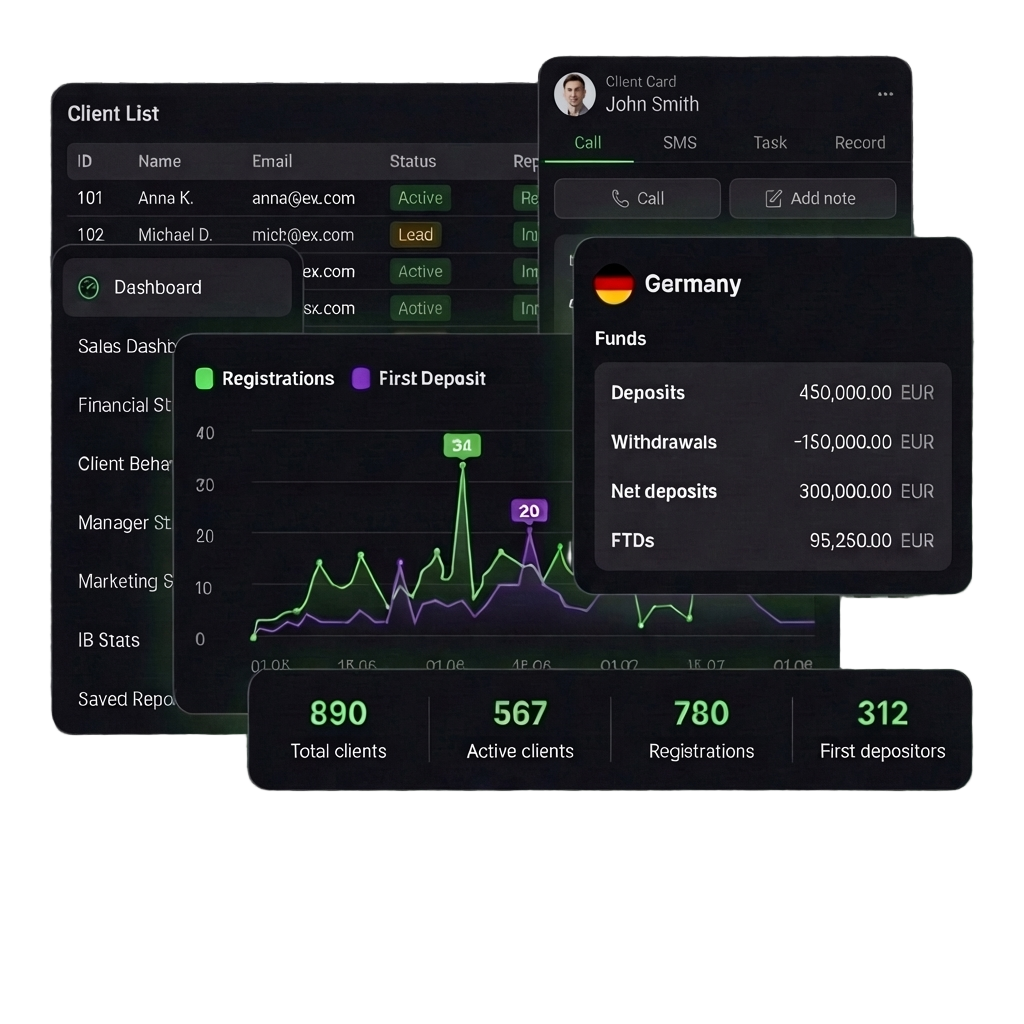

Analytics & Reporting

- Sales and conversion metrics

- FTD and deposit analytics

- Manager performance tracking

- Compliance and management reports

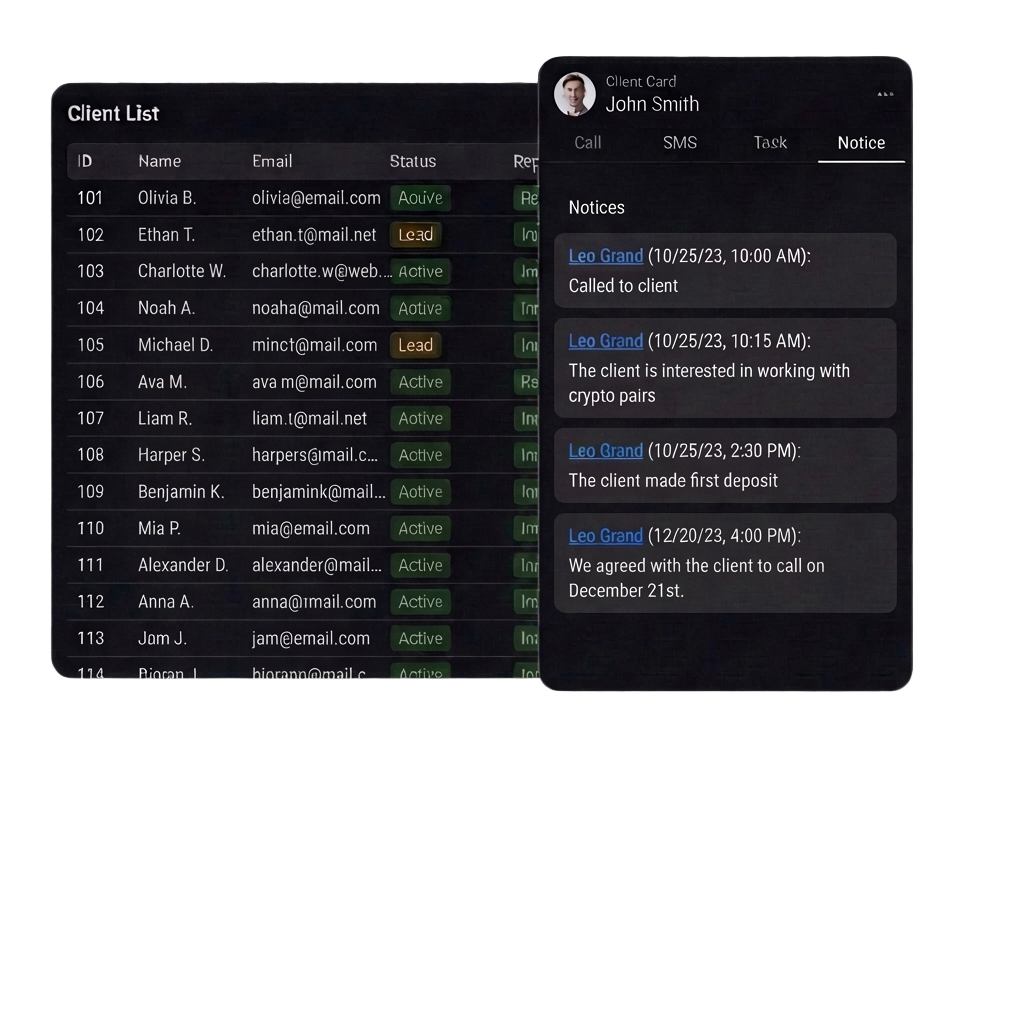

Client Auto Management Built for Brokers

Manage every client interaction from a single, fully automated workspace. Our Client Management module is designed to simplify and accelerate how brokers work with traders — from the first contact to long-term retention — without manual effort or disconnected tools.

See how automated broker operations look in practice →All Client Interactions in One Place

Every client profile contains a complete, real-time history of interaction:

- Calls, SMS, and messages

- Sales and retention status

- Tasks and follow-ups

- Deposits, activity, and account data

Your managers always know who the client is, where they are in the funnel, and what action comes next.

Workflow-Based Compliance Automation

Compliance is no longer a manual process.

- Automated KYC workflows based on predefined rules

- Trigger-based verification steps

- Automatic status updates and approvals

- Escalation flows for manual review when required

Each client follows a controlled, repeatable compliance process.

Full Control Over Deposits and Withdrawals

Full control over broker finances — secure, automated, and transparent.

- Real-time deposit tracking

- Automatic status updates

- Fast PSP integration

- Transparent exchange rate handling

Our Financial Module is designed to manage all deposit and withdrawal operations within a single system and complete control over client funds.

High-conversion with IB & Affiliate Management

Scale partner acquisition while keeping full control over performance and payouts.

- CPA, Revenue Share, Hybrid models

- Multi-level IB structures

- Custom commission rules per partner

- Volume-based and performance-based payouts

The system adapts to your business logic — not the other way around.

Speed up processes without micromanagement with the Workflow system

Increase trader lifetime value through smart automation.

- Automated retention tasks triggered by client activity

- Behavior-based triggers that react in real time

- Structured communication workflows across all channels

- Higher LTV with less manual effort

Turn trader behavior into timely actions — and retention into a scalable system.

Turn broker data into clear decisions with reports and live analytics

Complete visibility into your brokerage — without spreadsheets or guesswork.

- Real-Time Dashboard

- Manager & Department Analytics

- Financial & Conversion Reports

- Custom & Automated Reports

Clear, actionable reports that give you full control over your brokerage performance.

50+ ready-made integrations with external providers

Connect your brokerage tools quickly — and add new providers as you scale.

PSPs

VoIP

SMS

KYC

Open API

Why Brokers Trust Our CRM

Security, scalability, reliability — and a FinTech team that understands broker operations.

Enterprise-Grade Security

Built with industry-standard security practices to protect client data, financial information, and internal operations.

Scalable by Architecture

Designed to handle growth — from small teams to multi-brand brokerages with thousands of users.

High Availability & Reliability

Stable infrastructure ensures uninterrupted operations and consistent system performance.

Compliance-Oriented Development

Architecture and processes are built with regulatory environments in mind, reducing operational and compliance risks.

Experienced FinTech Team

Developed by a team with deep expertise in broker operations, CRM systems, and financial technologies.

Long-Term Product Vision

Continuous development, regular updates, and a roadmap aligned with broker business needs.

You get a product that evolves with your operation — new integrations, new automation, and improvements driven by real broker workflows.